Last Saturday, Christopher Zinn, with 600 runners, tackled the 80km ultra-marathon from Sydney's Bondi to Manly via the rocky, hilly, spectacular cliff and harbourside path… but why?

I had never seen myself as any kind of athlete or sportsperson, and apart from jogging and walking, I was content with being middlingly mobile.

I like learning new things, so six years ago, I went to the loca...

read more>

News

HOW CAN I PAY AS LITTLE AS POSSIBLE FOR AIRFARES?

1. Tune into regular airline sales & subscribe to their newsletter alerts:

The advantage of booking direct with an airline is that there’s no booking fee and if something goes wrong - say you miss a flight or you need to make a change - it can be much more difficult dealing with a third party site than dealing direct with the airline.

...

read more>

If you’ve got a relevant concession card (or in some cases a relevant Centrelink payment or income level) OR you're experiencing a financial emergency, there are potentially thousands of dollars in energy bill relief payments available to you in some states.

Since 1 July 2023, these rebate amounts have increased by up to $700.

So here’s a full list UPDATED to make sure you’re not missing ...

read more>

With energy prices soaring, every cent counts.

So to get your home running as efficiently as possible, see if you've already tried all of these 101 ideas for saving on Energy bills.

1. Switch retailers! Average households can save up to $600-$1200 on Electricity, depending on your postcode, in just a few minutes by shopping around, according to research by Vinnies.

👉 NB: You can CLICK ...

read more>

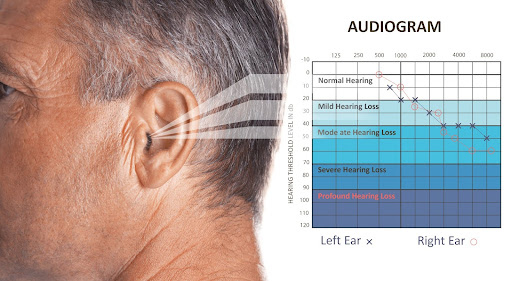

I don't like to admit it, but I have just taken an online hearing test after fearing I might be suffering from age-related hearing loss.

The issue arose after meeting an old pal last week who confessed to having installed a near-invisible in-ear (and expensive) hearing aid.

In his early sixties, he knew he was missing some conversations, especially in noisy eateries, but for vanity and fe...

read more>