Aeroplanes have hardly been fuller. Airfares have rarely been higher. It only makes sense because we are swapping the chains of the COVID bug for the delights of the travel bug.

The dreaded masks are no longer required, but the relentless queues, delays, lost luggage and sometimes frankly lousy customer service continues. So why do we do it?

Of all the economists’ jargon, the term ‘pent-u...

read more>

News

Source: https://majorstreet.com.au/products/live-the-life-you-want-with-the-money-you-have-vince-scully

What are the three questions the over-50s tend to ask one of Australia's most experienced financial planners about money? They’re simple enough, but if only the answers were so easy…

I presumed the three areas would be retirement, superannuation and the vexed area of wills and estate p...

read more>

Take the quiz here!

I am often unimpressed by the multitude of ‘days’ celebrating and commiserating various events, emotions and ‘-isms’.

They often seem contrived hooks for activists and agencies to impose memories and actions on an indifferent public.

It’s a crowded calendar. Last Saturday, for example, was World Coffee Day (isn’t every day?) and the United Nations’ day for recognis...

read more>

You’ve probably heard the fairy tale The Princess and the Pea, to which we may now add the real-life example of the petulant prince and the pen.

Ok, he was actually King Charles when he threw a wobbly after being presented with a leaky fountain pen for his royal signature in a Belfast visitor’s book.

But was his exasperation, “I can’t bear this bloody thing”, an example, as some critics p...

read more>

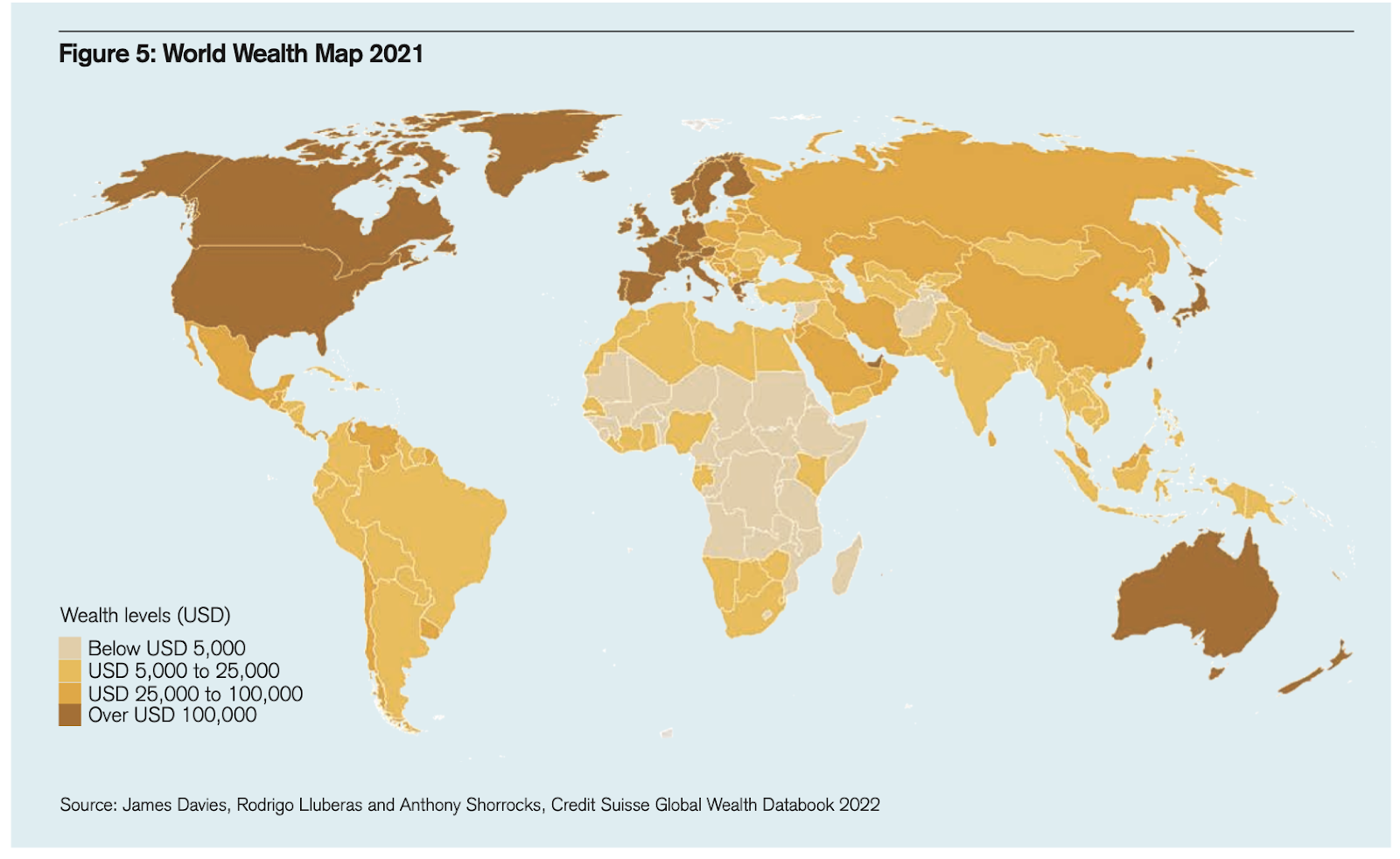

It’s funny, but I have mixed emotions hearing that Australians are now considered, at least by one measure, to be the wealthiest people on the entire Earth.

We should be joyful that the median, as opposed to average, Aussie adult now has a net worth of $413,260, beating the citizens of Belgium, NZ and Hong Kong.

If you are one of Australia’s 2.2 million millionaires, and an extra 390,000 ...

read more>