How can an 82yo afford a 13% premium increase?

With health insurance premiums set to rise by an average of 4.84% from April 1, the government says the increase will cost the average couple or family about $200 extra per year.

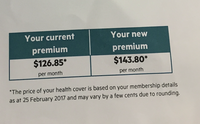

But imagine my surprise when I received a notification from my 82 year old mother’s health fund saying her premium was going up 13%!

Health Funds argue that they do not discriminate against older consumers but could the products that are targeted towards this cohort be priced higher than products aimed at younger consumers, thereby circumventing the discrimination card?

Doctors – and particularly specialists – have a lot to answer for when it comes to these huge premiums we are paying.

We’ve created a survey for FiftyUp Club members at the bottom of this post where you can tell us YOUR premium change and we’ll investigate what our members are really getting from their Health Funds.

The other issue at play here is the cost of gap payments that were highlighted this week in new research from Professor Gary Freed from the University of Melbourne.

For the first time, researchers have mapped the prices of 11 non-surgical specialist groups across Australia, allowing patients to see how their doctor's fees compare with others.

The study of "gap" or out-of-pocket fees – the difference between what Medicare pays for a specialist doctor's service and what the doctor believes their service is worth – comes amid rising concern about health costs in Australia and fears doctors are charging primarily what their local market will bear.

The research found that neurologists (brain specialists), endocrinologists (hormone specialists), rheumatologists (musculoskeletal specialists), and allergy and immunology specialists are charging some of the highest prices for private consultations outside the public health system.

Julia Medew writing for Fairfax reports many Australians are paying hundreds of dollars to see a specialist who may unbeknownst to them, and without any justification as to why, charge five times more than their peers.

Ten per cent of patients seeing these doctors are paying more than $170 out of pocket for an initial consultation, when the average "gap" fee for their specialty is $95-130. Under Australian laws, health insurers are not allowed to cover these out-of-pocket costs.

Fiftyup Club member Kym from NSW writes:

“My gap to the specialist was $8,000.00 and I have top cover. The gap is the issue and that is why so many people go public not private. Public, no insurance costs, no out of pocket expenses for hospital or doctor/specialist. Until these gap payments are reduced more & more people will go public.”

The research, published in the Medical Journal of Australia on Monday, also found differences across the states and territories, More than 70 per cent of consultations were bulk-billed in the Northern Territory, compared with less than 50 per cent in Victoria and New South Wales.

There have been calls for doctors to publish their fees on comparison-websites so patients can shop around.

A spokesman for Health Minister Greg Hunt said large out-of-pocket fees were of concern and that doctors and specialists were obliged to fully explain costs to patients.

Michael Gannon, President of the Australian Medical Association said doctors charged private fees above what Medicare paid them because they have to meet their own rising costs, for staff, utilities, and indemnity insurance.

In response to Dr Gannon and as a sign of good faith, maybe specialists should also be transparent as to what exactly those indemnity, utility and staff costs are.

Doctors are essentially running a business and offering a service much the same as your local builder. If a builder can give you an upfront quote that you can then compare in the market, why can’t doctors do the same? Builders have indemnity, staff and utility costs also, as do most businesses, but for some reason the word “untouchable” comes to mind when we talk about doctors.

CLICK HERE to take the survey on Health Premiums