Over 55's are being hit by larger-than-average premium increases

New evidence suggests the Over-50s are once again getting bigger premium increases than the general population as the April 1 deadline approaches for Health Insurance price rises.

The national average increase might be 4.8%, but a new FiftyUp Club poll of 500 people revealed:

- 65% of us will face a health premium rise greater than 5 per cent

- 45% are planning on dropping or downgrading their cover, and

- 60% are “furious” about the latest premium increase

Last week I revealed my mum’s premium had increased by 13% and this week we heard from one 79-year-old Queensland member hit with a whopping 14.7% increase!

“I have tried on 2 occasions to phone them but gave up after 20 mins!” they said.

Click here to see the members’ offer from HCF, or call the hotline for a quote: 1800 345 044

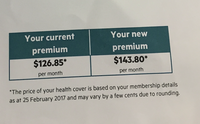

As the April 1 deadline approaches and we all have to dig a little deeper into our pockets to pay for private health insurance, many members have started receiving notification letters from their funds explaining their increase.

Half of Private Health Insurance customers aged over 50 are receiving premium increases over 7% on April 1 – much higher than the 4.8% average announced by the Government.

Last week I revealed my mum’s premium had increased by 13% and this week we hear from one 79-year-old Queensland member hit with a whopping 14.7% increase.

A new FiftyUp Club poll of 500 over-50s revealed:

- 65% will face a health premium rise greater than 5 per cent

- 45% are planning on dropping or downgrading their cover, and

- 60% are “furious” about the latest premium increase

Health premiums are set to rise by an average of 4.84% from April 1, the survey shows older Australians’ health premium prices hikes do not reflect the national average.

Health funds have been notifying their members about premium increases that are much higher than the average increase, and it risks pushing over 50s out of private health care at a time when they need it most.

The latest increase comes as private health coverage is going backwards for the first time in 15 years. Health premiums have risen 71% in a decade, yet the latest increase has been touted as “the lowest annual increase in a decade[1]”.

Last week’s blog on Health insurance (read here) certainly started a flurry of response from members:

Leonie from QLD offered advice: “Simple...... we’re all over 50 now.... change health insurance companies. “

Annette from VIC says: “I too feel cross about the price hikes but without private cover I would have had to wait months and months before seeing a specialist and then to wait even longer for surgery. There needs to be a better compromise with tax relief for those who pay their own way.”

- Click here to see the latest health offer

- Click here to hear the interview with Dr Ross Walker on how Australians are paying 4 times more for medications than our kiwi neighbours

- Click here to here about a great health insurance hack that could save you thousands